Highlights

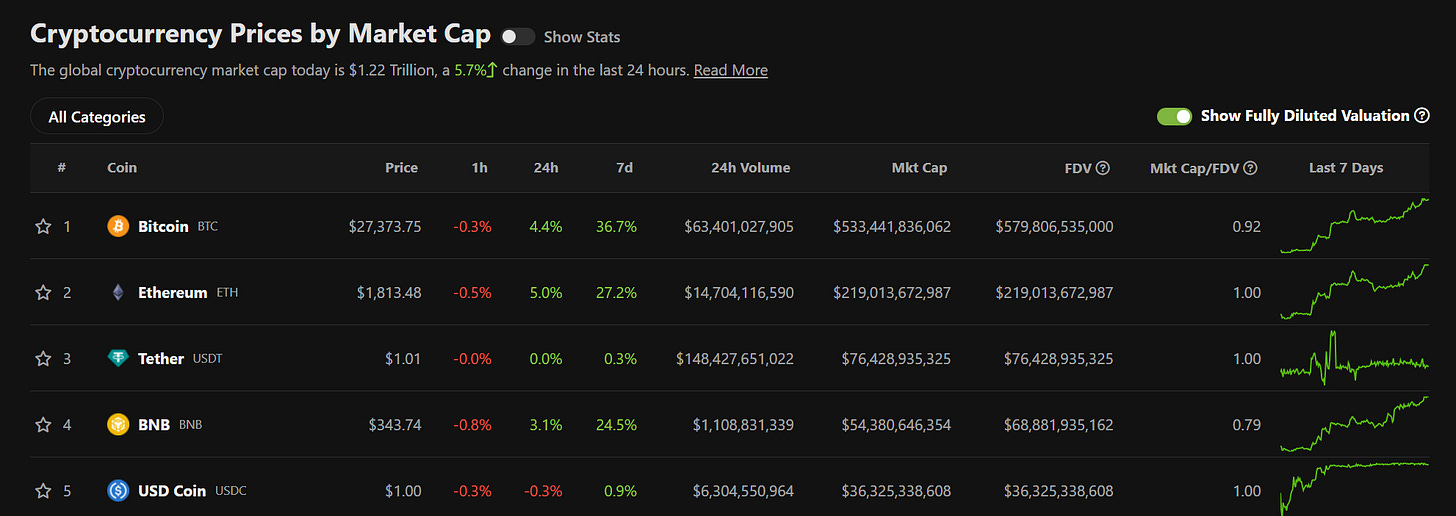

Impressive move by especially BTC after a turbulent week (well covered in this week additional newsletters) and ECB hiking. Lower interest rate expectations and governement interventions to save banks, spurred a broad based crypto rally. BTC 66% year-to-date (YTD) growth is vastly outperforming top Wall Street bank stocks, particularly as fears of a global banking crisis are rising. Speaking of which:

Credit Suisse CFO teams to hold talks this weekend on scenarios for bank (RTRS) Credit Suisse AG will be holding meetings over the weekend to assess scenarios for the bank as it struggles to regain confidence from the market.

https://www.reuters.com/business/finance/credit-suisse-cfo-teams-hold-talks-this-weekend-scenarios-bank-sources-2023-03-17/

To all (F)influencers with your affiliates, promo’s, bonusses etc: Pay attention!

https://decrypt.co/123810/youtube-influencers-bitboy-1-billion-lawsuit-ftx

What’s next:

Volatility ahead in crypto markets:

First, the impact on market liquidity will be broad. With Silvergate and now Signature’s closure, crypto market infrastructure has taken a step back as the industry becomes more cut off from the traditional banking system. Real-time payments networks such as Silvergate’s Exchange Network (SEN) and SigNet were crucial for managing overnight and weekends liquidity — facilitating OTC deals, arbitrage between exchanges and stablecoin redemptions outside regular opening hours. With these solutions gone and no alternative for now, fiat on-ramps will likely deteriorate creating perfect conditions for volatile price moves.

Second, despite improved market wide liquidity via the Fed’s newly created BTFP facility, monetary policy uncertainty has risen which could fuel further risk aversion among institutional traders. Market expectations for the Fed’s terminal rate fell from nearly 6% last week to around 5% as of Monday morning according to U.S. interest rate futures. Expectations for a 50bps rate hike at next week’s Fed meeting went from 40% to zero within days according to the CME FedWatch tool.

Despite “Operation Chokepoint” Crypto exchange Coinbase is exploring launching an offshore platform to trade perpetual swaps tied to cryptocurrencies, according to two sources familiar with the firm’s aspirations.

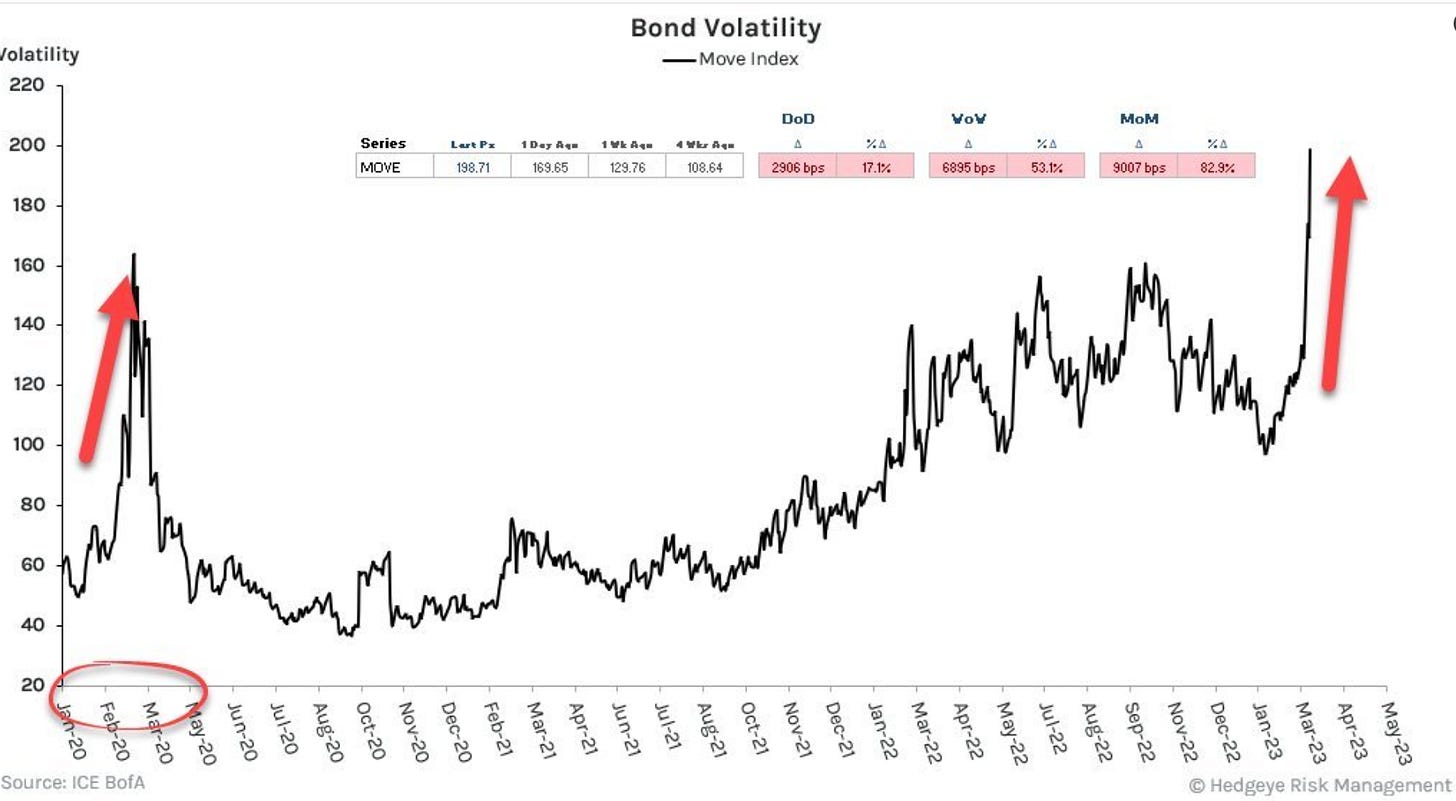

On the tradfi side: This crisis is far from over…… Short selling restrictions coming up?

Bond volatility? Probably nothing… (courtesy Hedgeye).

Coin/Ecosystem News:

Binance: to use its own token for its Industry Recovery Initiative Fund. Sounds Ponzi-esh…..

https://www.coindesk.com/markets/2023/03/13/binance-will-convert-1b-worth-of-busd-stablecoin-to-bitcoin-ether-bnb-and-other-tokens/

Arbitrum Airdrop (ARB):

Layer-2 scaling solution Arbitrum has announced its long-anticipated ARB token to users of its ecosystem giving users 12.75% of the total token supply. Arbitrum's new token will be airdropped to community members on Thursday, March 23. This will mark the transition of Arbitrum into a DAO, granting ARB holders the power to vote on key decisions regarding Arbitrum One and Arbitrum Nova governance.

BTC Derivatives:

https://www.coindesk.com/markets/2023/03/14/bitcoin-options-volume-on-deribit-hits-highest-level-in-22-months-as-bank-failures-breed-volatility/?outputType=amp

Trading/Positioning

Obviously active in trading the satellite positions with core unchanged.

Portfolio I Total Indicative Long Exposure: 157%

Portfolio I Total Indicative Short Exposure: 70%

Note: My clients get full disclosure and a complete overview of all portfolios, positions and trades.